Success and further growth: sharing results for 2023

12.03.2024

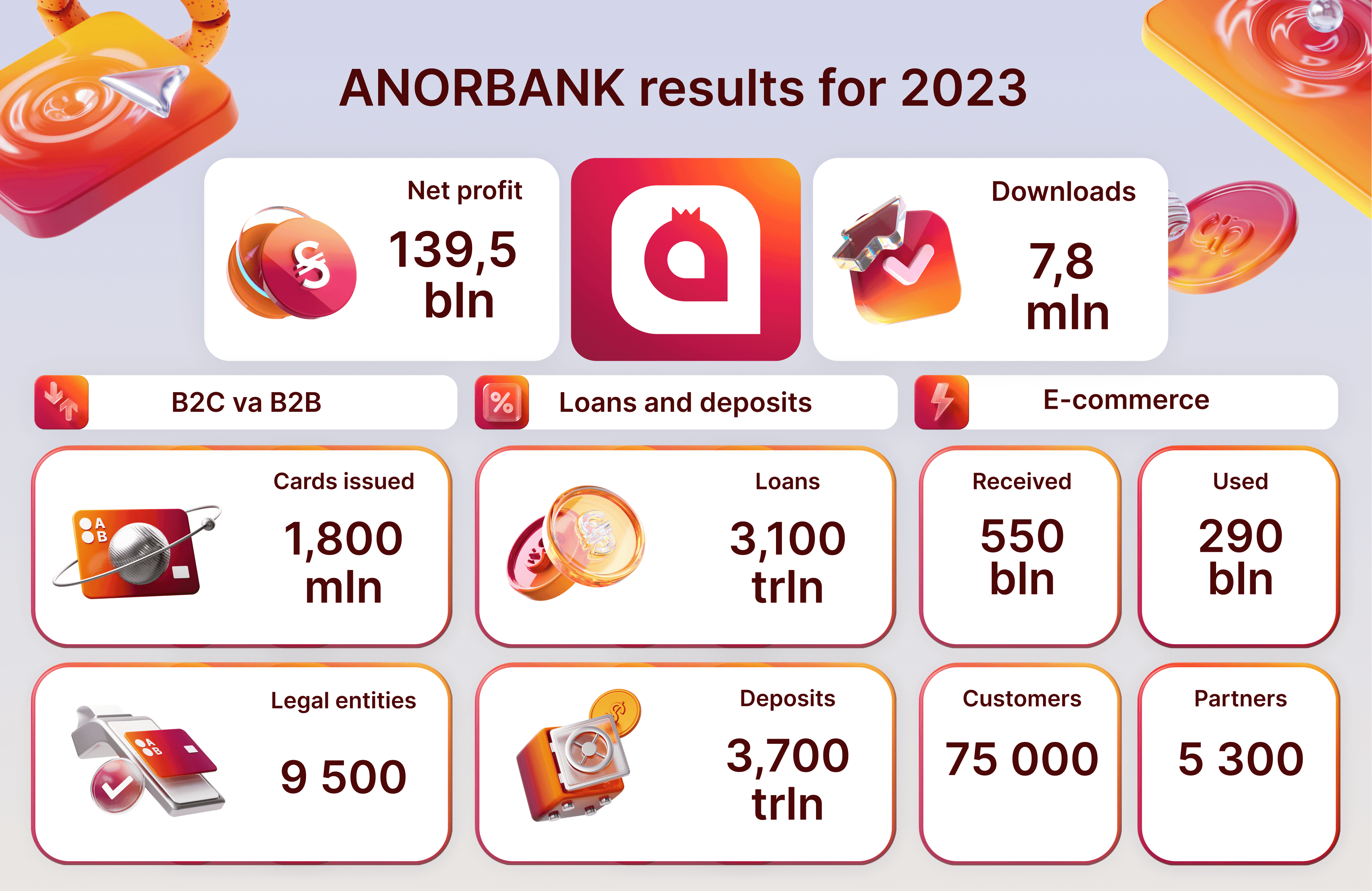

These are the results for 2023, which confirm the desire for success and stable growth in various areas of activity. Indicators such as net profit, customer base and loan portfolio growth highlight its significant position in the financial market of Uzbekistan.

Financial indicators

The bank's net profit for 2023 reached an impressive level of 139.5 billion soums. This result indicates the stability and effectiveness of the financial strategies implemented by the bank. It is worth noting that since its launch in Uzbekistan, every year for ANORBANK has ended with a profit.

Engagement figures

Interest in the bank and its services continues to grow: the Anorbank application has been downloaded more than 7.8 million times. It is very important to note the increase in the number of registered users, which exceeded 4 million people.

Credit and deposit activities

ANORBANK continues to successfully develop its loan and deposit portfolio. The total loan portfolio of individuals and legal entities exceeded 3.1 trillion soums. Deposits of individuals and legal entities increased to over 3.7 trillion soums.

Today, ANORBANK is among the TOP 10 banks in Uzbekistan in terms of the total volume of deposits of individuals in national currency. In terms of the loan portfolio of individuals, the bank is in the TOP 15 banks in the country.

Key indicators

The bank remains in demand both among individuals with the issuance of 1.8 million debit cards, and among legal entities, where the client base exceeded 9.5 thousand companies. It is important to note that ANORBANK is currently among the TOP 10 banks in Uzbekistan in terms of the number of cards in circulation.

In addition, ANORBANK continues to develop one of its first products, the installment card “ANOR”.

The network of partners amounted to 5,261. Popular categories included: household appliances and electronics, jewelry, clothing and footwear, tourism.

There are 55 thousand active clients, the fact that the limits have been renewed is especially noteworthy; this indicates that clients have experienced the convenience and financial benefits of an installment card.

At the end of 2023, the total approved amount was 550 billion soums, of which 290 billion soums were used. In 2023, the bank introduced new products to customers, including the UzCard Duo card and deposits with high interest rates - up to 27%.

It is impossible not to note the fact of creating complete amenities for visitors and clients of the bank. In 2023, ANORBANK launched offline cash registers in all sales offices. This was done so that clients could carry out cash transactions:

- loan repayment;

- replenishment of cards and deposits;

- collection of legal entities.

Future plans

ANORBANK's management is confident in the bank's further success and sets ambitious goals. The Bank strives to further increase its customer base and expand the geography of its services.

In addition, ANORBANK is aimed at actively developing a digital platform to ensure maximum convenience and accessibility of services for all clients.

Follow the news on the bank's official channels.

Read more